How do I upload and share K-1 documents with my investors (LPs)?

Tax season can be busy for GPs. They need to provide Schedule K-1 forms (or K1s) to all their investors. On the Covercy Platform, the GP can upload and share the documents with their investors in a few simple steps. Learn how.

K-1s provide the necessary information for investors to accurately report their share of the entity's income or losses on their personal tax returns. K-1s can also show performance of the investments. The document specifically shows income, deductions, tax withheld, credits and other fiscal data.

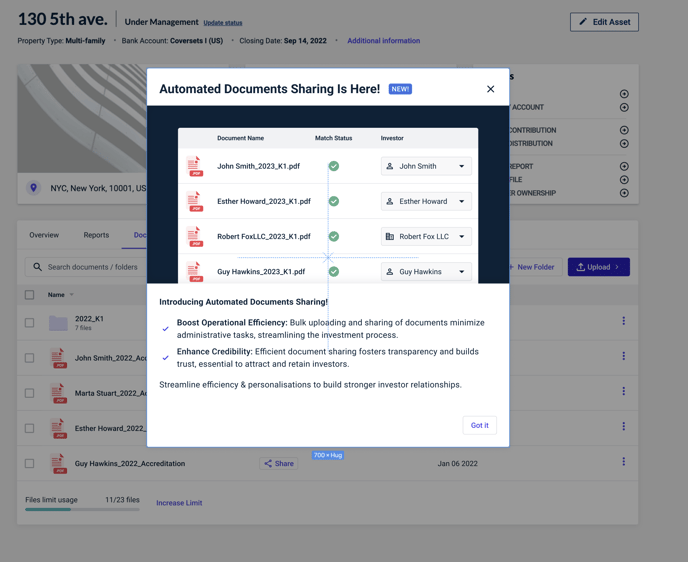

Bulk uploading of K-1 documents can streamline a GPs operations and enhances credibility with investors.

Follow these simple steps to upload and share K-1s with your investors:

1. In your asset, under the documents tab select Upload button, and choose to upload and share.

.png?width=688&height=567&name=image%20(98).png)

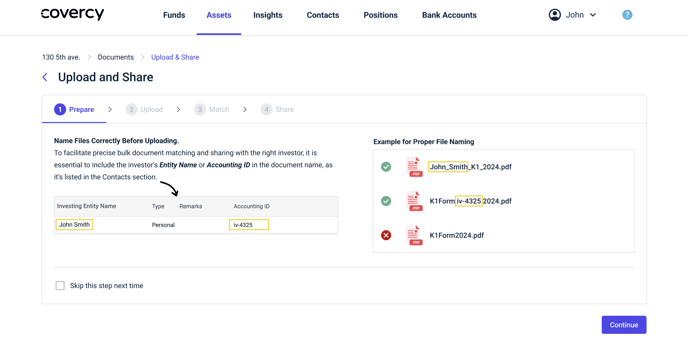

2. A tip before uploading: make sure the file includes either the entity name or Accounting ID.

3. Select files to upload.

.png?width=688&height=341&name=image%20(99).png)

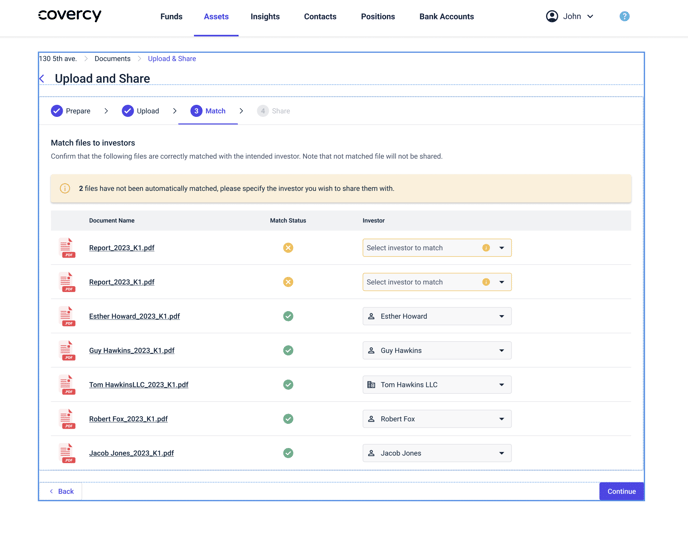

4. Once the files are uploaded, they are matched with your investors. If some do not match, you can manually select where the files should go.

5. If there are files that couldn't be matched, a notification will be displayed, prompting the user

to assign the correct matches. Users also have the option to conclude the process without

sharing all the files. Additionally, files can be previewed by clicking on their names.

Now your investors will see their file in the Investor Portal.