How do I connect an external bank account to my Covercy Wallet?

Covercy provides a solution for customers to consolidate their financial overview in a single platform, eliminating cumbersome access to multiple institutions and multiple accounts. In this article, learn how to connect your external bank accounts.

The Covercy Platform allows a GP (General Partner) to manage their investment properties all in one place. Finally, one platform where investors, real estate and even payments come together. This eliminates the need for cumbersome access to multiple institutions and multiple account checks. Additionally, Covercy offers a contextual view, enabling users to organize and view their accounts based on the specific deal.

All account balances will be visible on the Covercy platform, including the ability to select any account and view all its transactions right on the platform.

Next, read about the steps to connect your accounts. Detailed benefits will be added at the end.

Step 1. On the top navigation menu, go to “Bank Accounts”

Step 2. Go to the “My Accounts” tab

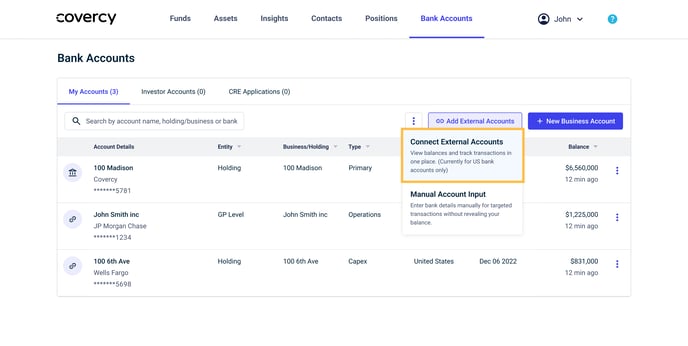

Step 3. Connect bank accounts from multiple institutions

-

Select "Connect External Account" to immediately connect existing bank accounts from any financial institution.

-

Alternatively, open a new Covercy banking account to enjoy benefits such as high yield APY checking account(s), up to $3M in FDIC insurance per entity, and numerous other advantages for fundraising and distributions.

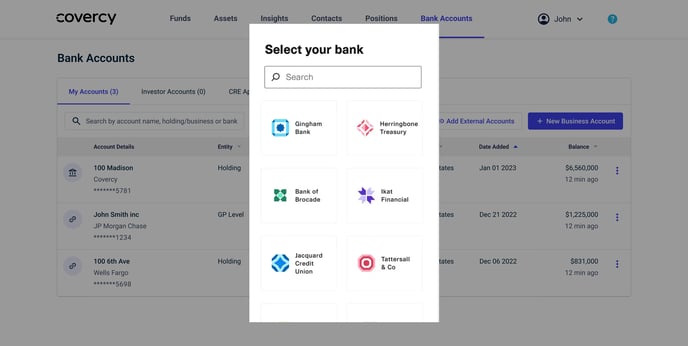

Step 4. Go through the connection process

-

Select the institution of the accounts you wish to connect

-

Go through the verification process until completion

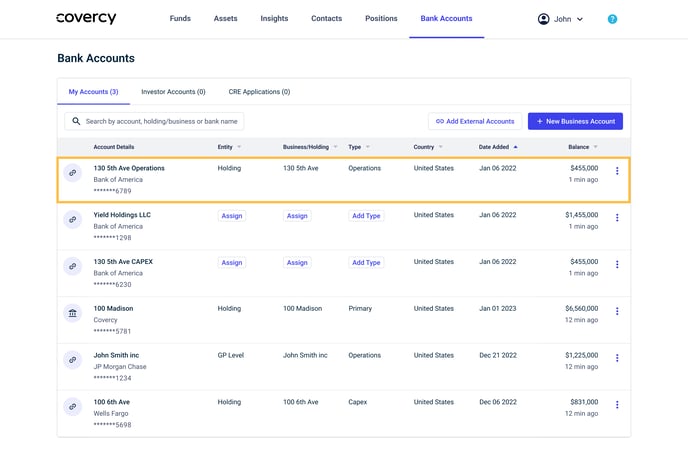

Step 5. After completing the connection process, your accounts and their respective balances will be listed under the "My Accounts" tab.

.png?width=688&height=462&name=connect_external_accounts_5%20(2).png)

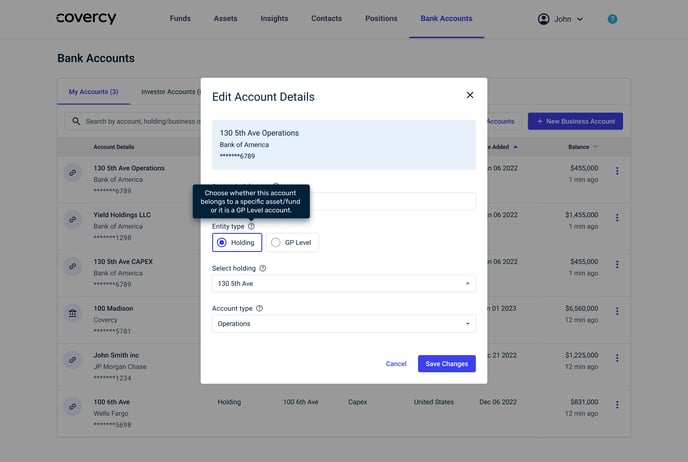

Step 6. Now, you should Assign each account to its deal to ensure it is displayed in the correct context. After the account is Assigned to a deal, it will also be displayed in the deal (Asset/Fund) page.

You are all set.

All your balances are now conveniently accessible on a single platform; simply click on any account to explore its transactions.

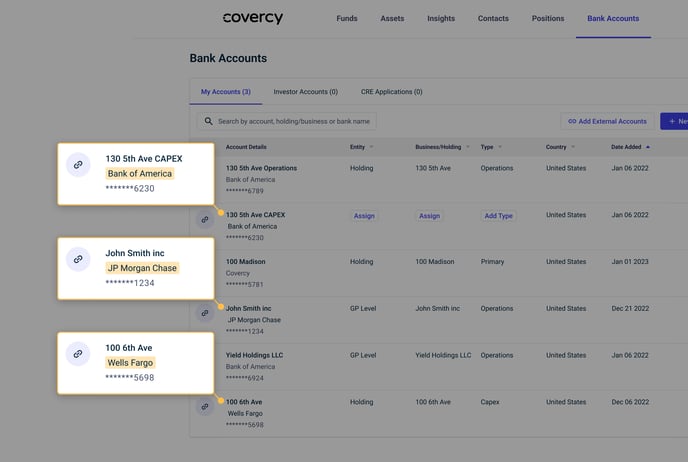

If you hold accounts across multiple institutions, follow the same steps to include all your institutions and consolidate your financial information in one place.

Some great things about the Covercy Investment Management Platform is your ability to view all your bank accounts by each of your real estate assets.

1. You can view all your bank accounts and balances in one place from all your financial institutions.

2. With Covercy's deal contextual view, your workflow is streamlined by displaying only the accounts relevant to the deal you’re focusing on. This is particularly useful when managing a large portfolio, allowing you to quickly assess the financial status of each deal without sifting through dozens of unrelated accounts. This ability saves time and sharpens decision-making, focusing on what's essential.

3. Easily select any account to view all its transactions directly on the platform, consolidating information from both single and multiple institutions. This eliminates the need to navigate between different banks or search through various accounts, providing all the necessary context conveniently in one place.

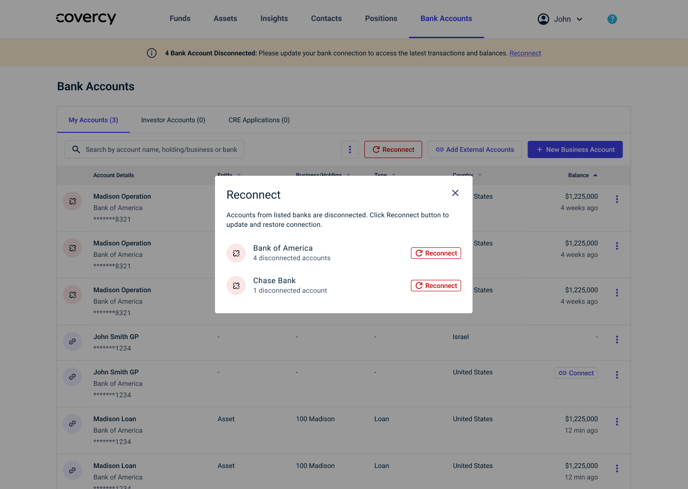

Reconnect Your Accounts

Should your accounts get disconnected due to your bank's connection timeout policy or a password update, you'll receive a notification on the platform.

Simply click the “Reconnect” button and follow the steps for authorization to seamlessly reconnect your accounts..png?width=688&height=489&name=My%20Accounts%20table%20(4).png)

If accounts from multiple institutions have been disconnected, clicking "Reconnect" will prompt you to select which institution you wish to reconnect first. After successfully reconnecting the first institution's account, you'll need to click "Reconnect" again for each remaining institution until all accounts are reconnected.